Venture Capital and Private Equity in 2023

In the shifting sands of 2023's market, private equity (PE) and venture capital (VC) navigated through a labyrinth of economic volatility, diverging in performance and strategy as they faced the headwinds of rising interest rates and regulatory shifts. While VC faced a retrenchment after a period of ebullient growth, PE demonstrated resilience, exploiting niches and adapting strategies to meet the challenges of an increasingly complex investment climate.

The year was marked by a confluence of factors that reconfigured the investment landscape: the aftereffects of a mini-banking crisis, recalibrated capital costs, and a persistent valuation gap between buyers and sellers. Against this backdrop, sectors like technology and professional services shone as beacons of potential growth, with artificial intelligence advancements fuelling activity and optimism for future disruptions in deal sourcing and due diligence processes (Cherry Bekaert) (McKinsey & Company).

Despite a general fundraising contraction, PE sustained its momentum, capitalizing on opportunities that emerged from market dislocations and the dynamism of the technology sector. Carve-outs and strategic add-on transactions continued to thrive, affirming the sector's capability to pivot and innovate amidst market turbulence (Cherry Bekaert).

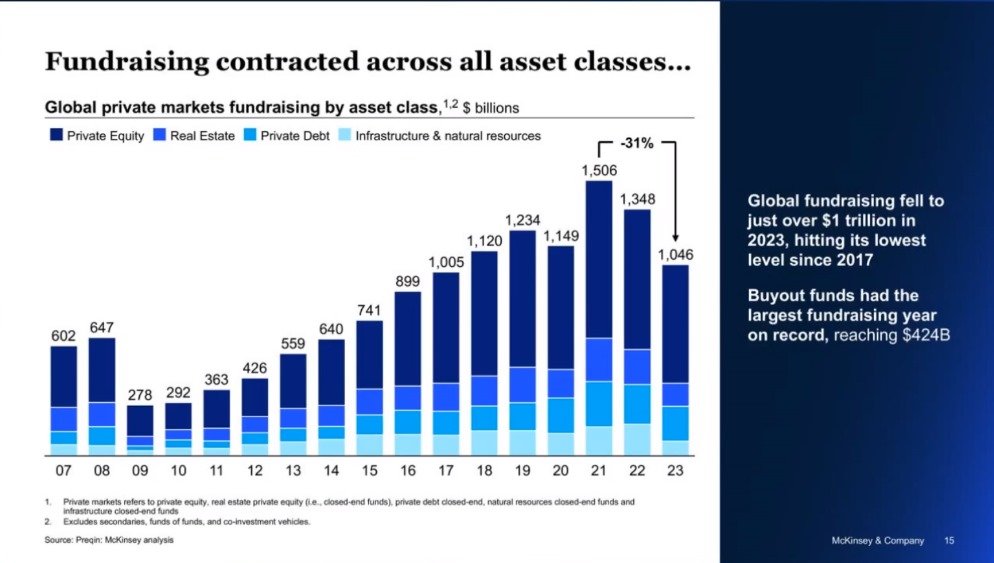

Venture capital, however, found itself on less stable ground. The fervor that once defined the space gave way to a cautious recalibration as investors reassessed their portfolios in light of the heightened risks associated with a slower economy. The once rapid pace of fundraising witnessed a notable deceleration, dropping to levels not seen since 2015, as VC firms grappled with a lingering hangover from earlier exuberance (McKinsey & Company).

The fundraising landscape mirrored these divergent paths: while global private equity fundraising contracted, the mega-funds weathered the storm, securing sizable commitments and outperforming smaller counterparts. The year unfolded as a tale of two markets, with larger, established players consolidating their positions and emerging managers facing an uphill battle in a climate of cautious investor sentiment and stringent due diligence (McKinsey & Company) (MorganFranklin Consulting).

2023 also witnessed PE firms reimagining their value-creation strategies. As low-cost funds and favorable M&A conditions of previous years receded, firms turned to fundamental principles—revenue growth, cost reductions, operational efficiencies—and integrating artificial intelligence into investment decisions to navigate the evolving landscape (MorganFranklin Consulting).

As a private market analyst, I believe these trends not only underline the necessity for prospective investors to consider the market dynamics carefully but also highlight the importance of adaptability and foresight in investment strategies. With a keen eye on the ever-evolving sectoral opportunities and the macroeconomic signals, PE and VC can continue to be dynamic avenues for growth, even in the face of market headwinds.

Venture Capital's Challenging Year

2023 proved to be a crucible year for venture capital, which saw a stark reversal of its erstwhile upward trajectory. The sector, once buoyed by aggressive growth and the promise of tech-driven prosperity, contended with a cooling fundraising environment, reaching levels reminiscent of the more conservative market of 2015. High-profile bank collapses early in the year exacerbated liquidity concerns, with reverberations felt throughout the VC sphere as credit sources tightened and valuation benchmarks realigned (Cherry Bekaert).

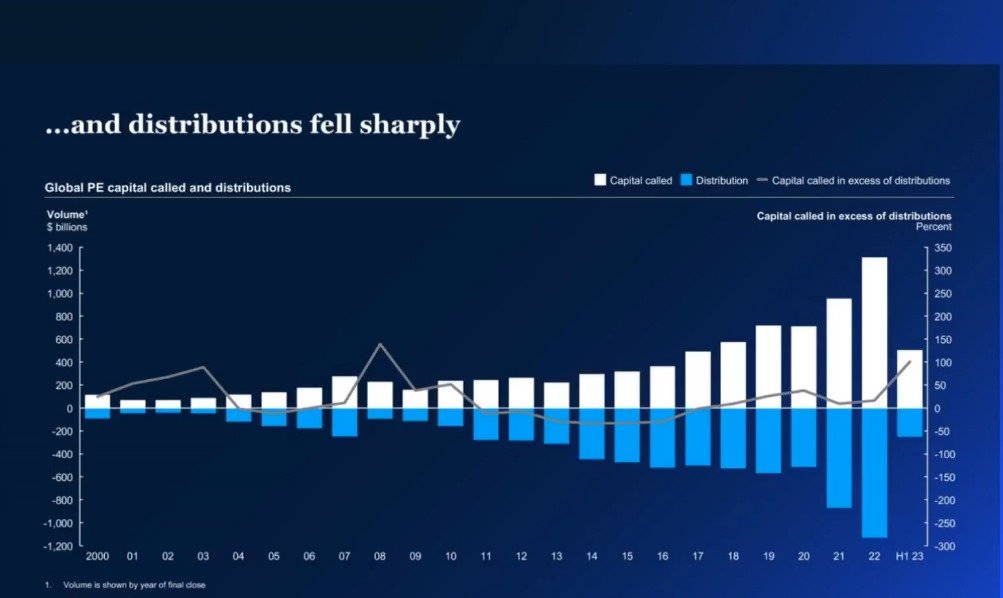

The much-discussed phenomenon of 'megadeals' faced new hurdles, with traditional lending routes constrained by prior years' overhang and a shift towards more conservative stances by financial institutions. The resultant decline in deal volumes, particularly in sectors previously flush with cash and buoyed by high multiples, signaled a shift in the investment narrative, steering clear of the blockbuster deals that had characterized the VC landscape in years past (MorganFranklin Consulting).

As public market valuations underwent tumultuous fluctuations, venture capital was impelled to reassess and recalibrate, leading to nuanced shifts in market dynamics that rippled across M&A activity. This section will detail the trials and adjustments within the venture capital ecosystem, painting a vivid picture of its trials and tribulations in 2023.

Private Equity's Resilient Performance

Contrastingly, private equity displayed remarkable resilience in the face of these market headwinds, achieving the largest fundraising year on record. The sector's steadfastness was rooted in its ability to adapt and capitalize on strategic transactions and sector-specific opportunities. The growth was particularly notable within the technology and professional services sectors, which remained robust despite broader economic challenges (Cherry Bekaert).

Buyouts continued to be a linchpin of PE success, with mega-funds especially thriving and drawing record commitments. This section will delve into how PE firms navigated the fundraising environment, the strategies that allowed them to succeed, and the factors contributing to the industry’s durability even as fundraising dipped globally (MorganFranklin Consulting).

Comparative Analysis: VC and PE Fundraising Trends

Comparing the two sectors, the diverging narratives of venture capital and private equity in 2023 are starkly visible. VC fundraising waned significantly, a reflection of investor reassessment and a more cautious approach to new commitments. In contrast, PE, particularly buyout funds, had their best fundraising year, signaling investor confidence and a flight to quality amidst uncertainty (McKinsey & Company).

Global Fundraising Challenges

The contraction in fundraising was not limited to VC; it was a pervasive theme across all asset classes, with global fundraising dropping to just over $1 trillion, its lowest since 2009. The 'denominator effect' played a role in this dynamic, influencing investor behavior and allocations. Even amidst this tightening, private markets assets under management (AUM) continued to grow, albeit at a tempered pace, as investors and fund managers adapted to the new normal (McKinsey & Company).

Conclusion and Outlook

The article offers a prospective outlook based on the prevailing trends of 2023. While the PE market remains robust, VC faces a period of introspection and recalibration. Both sectors must navigate an evolving macroeconomic landscape, which includes rising interest rates and inflation, to emerge successfully in 2024 and beyond.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be based on individual financial objectives and due diligence.